Managing FundsDreams Since 2004

Maximising mutual fund returns through research– Zero Guesswork

Maximising mutual fund returns through research– Zero Guesswork

Maximising mutual fund returns through research– Zero Guesswork

Track SIPs, plan goals, get expert tips - invest with confidence.

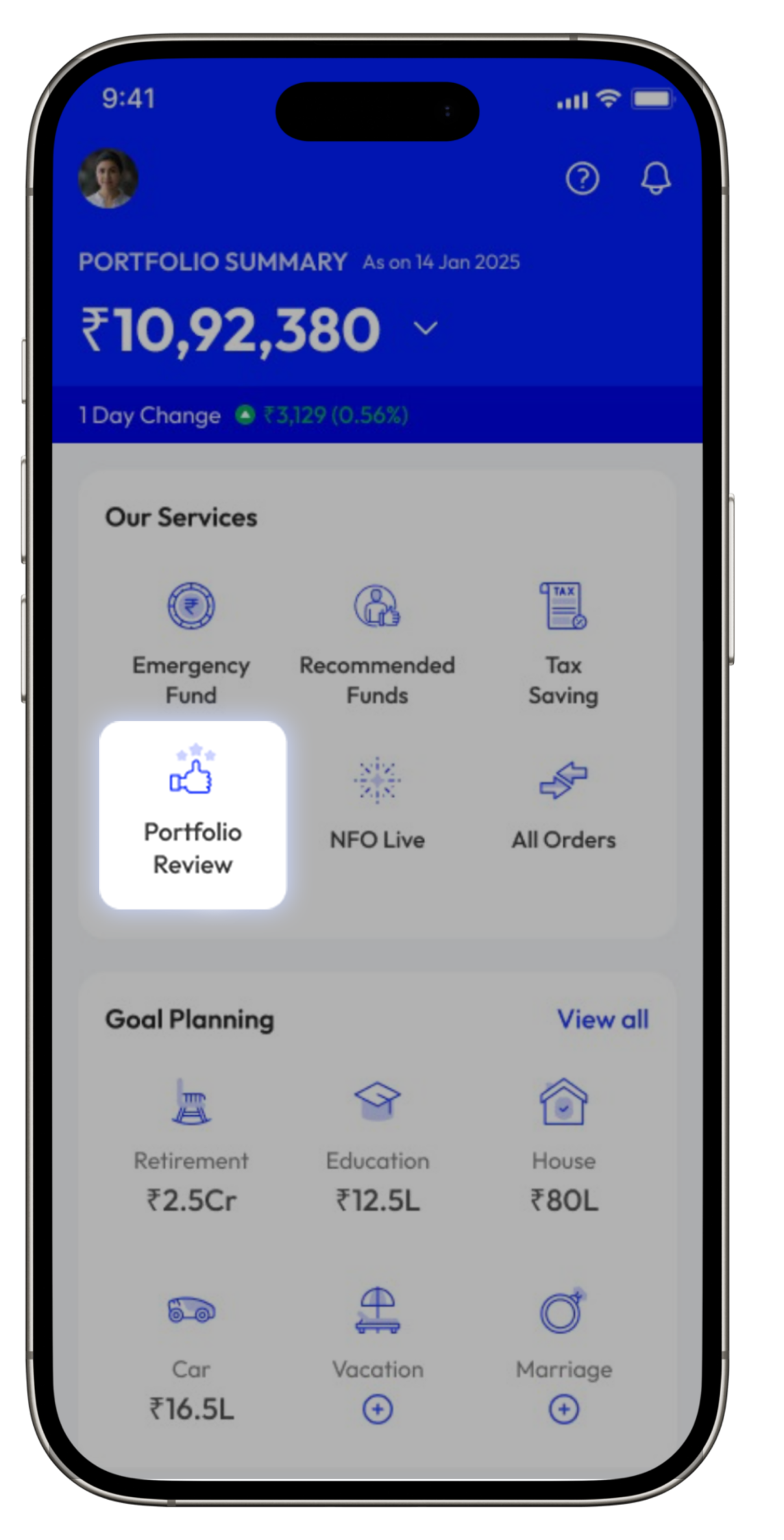

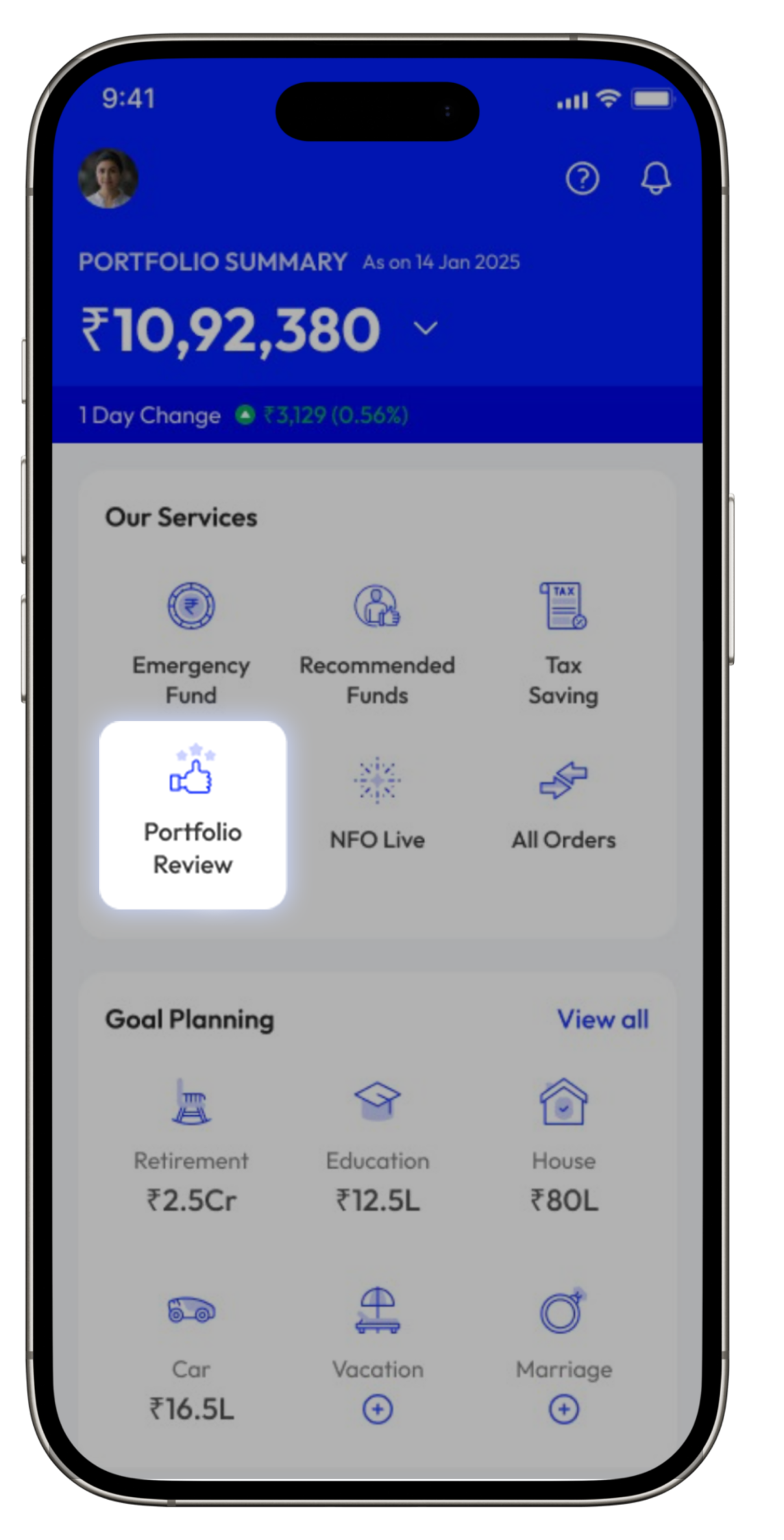

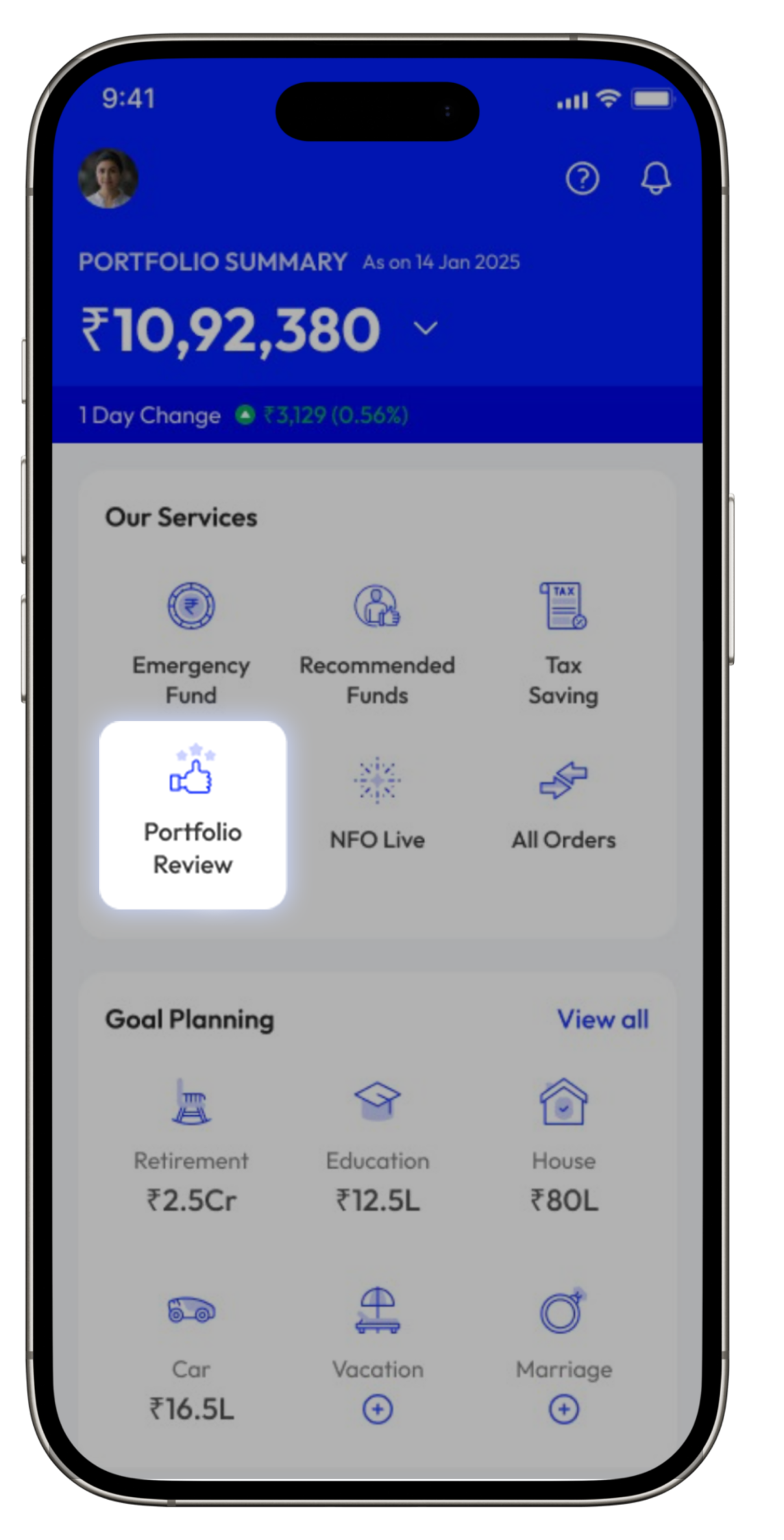

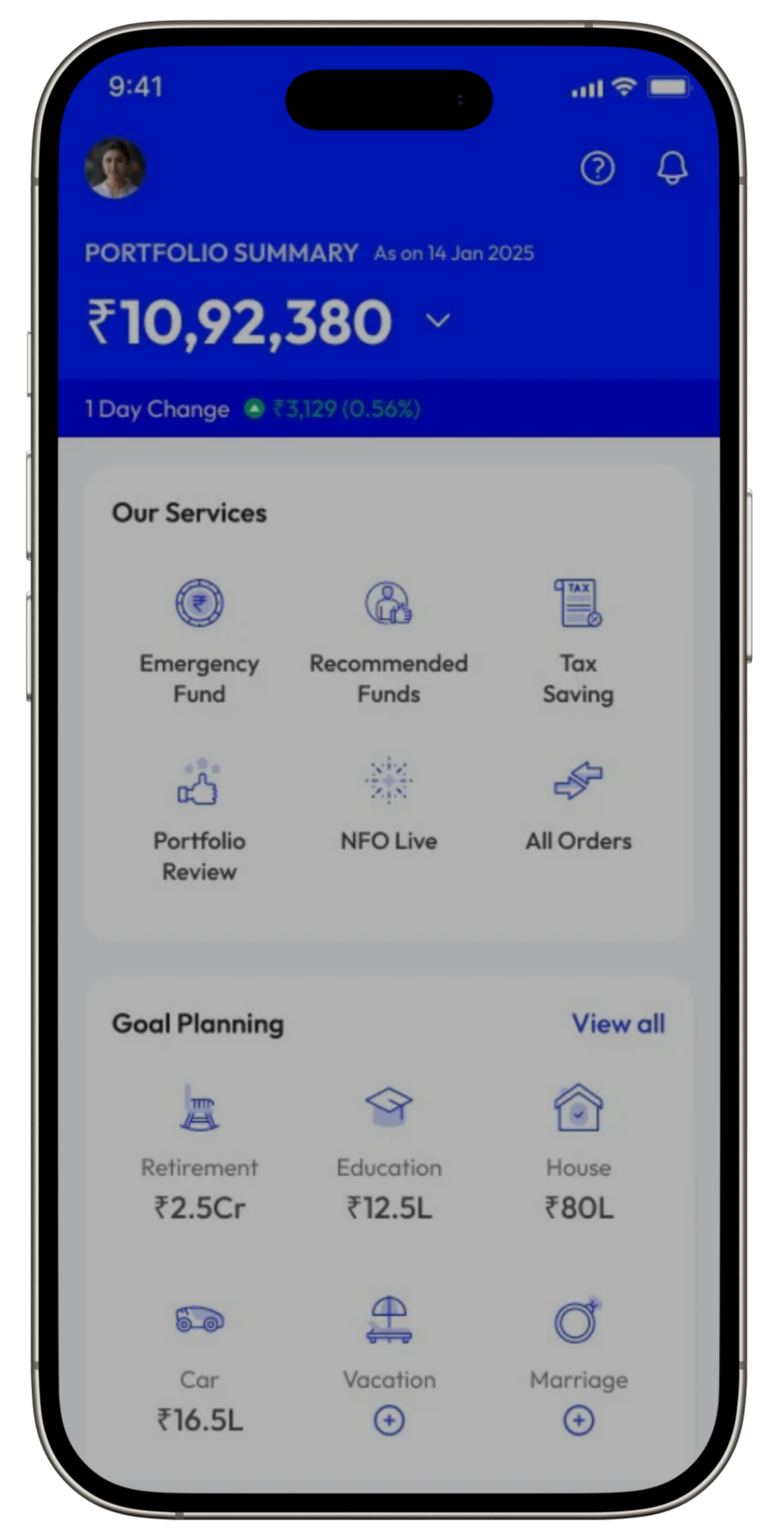

An all-inclusive suite for investing, trading, retirement planning & tax filing

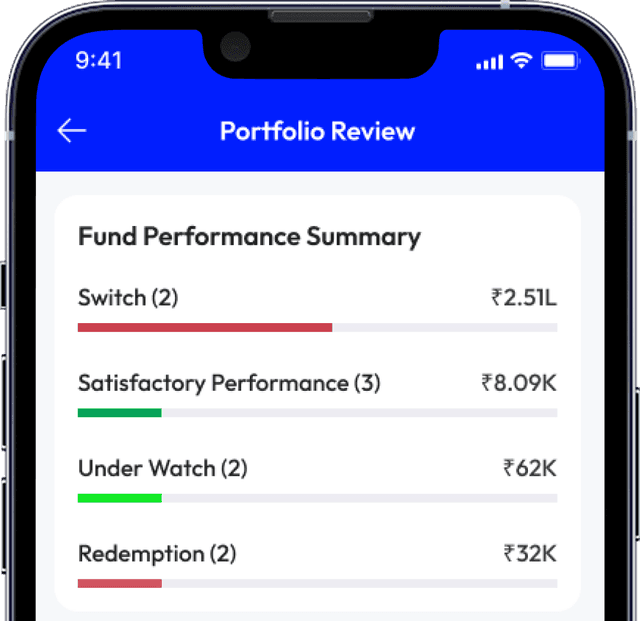

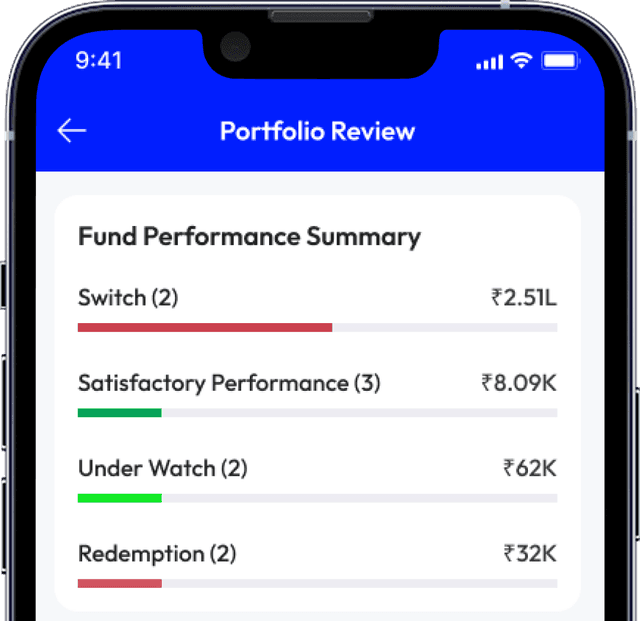

Review your portfolio anytime, as many times as you want, completely free of cost. Get accurate, real-time insights so you’re always in control of your investments- and your future too!

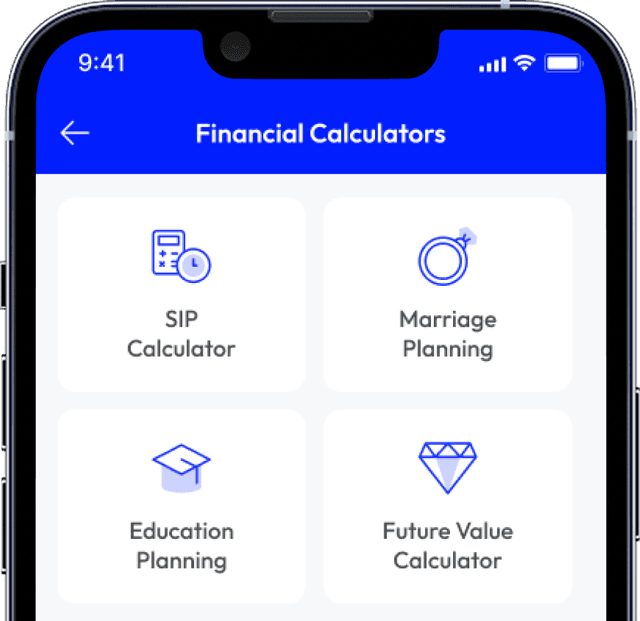

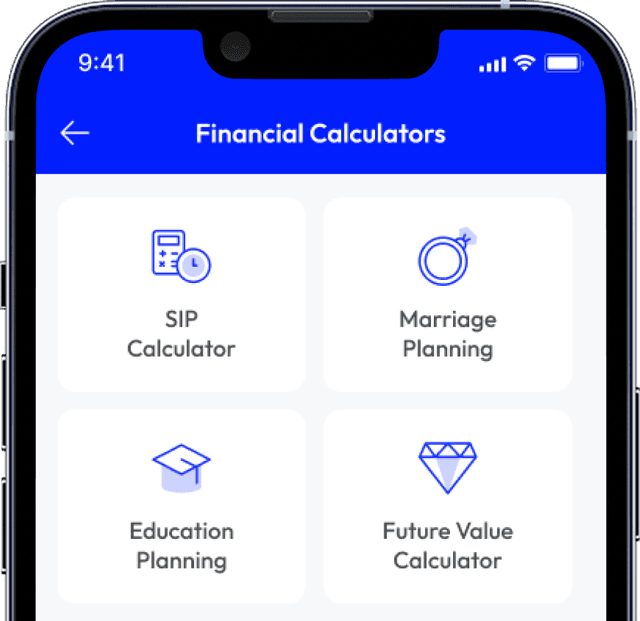

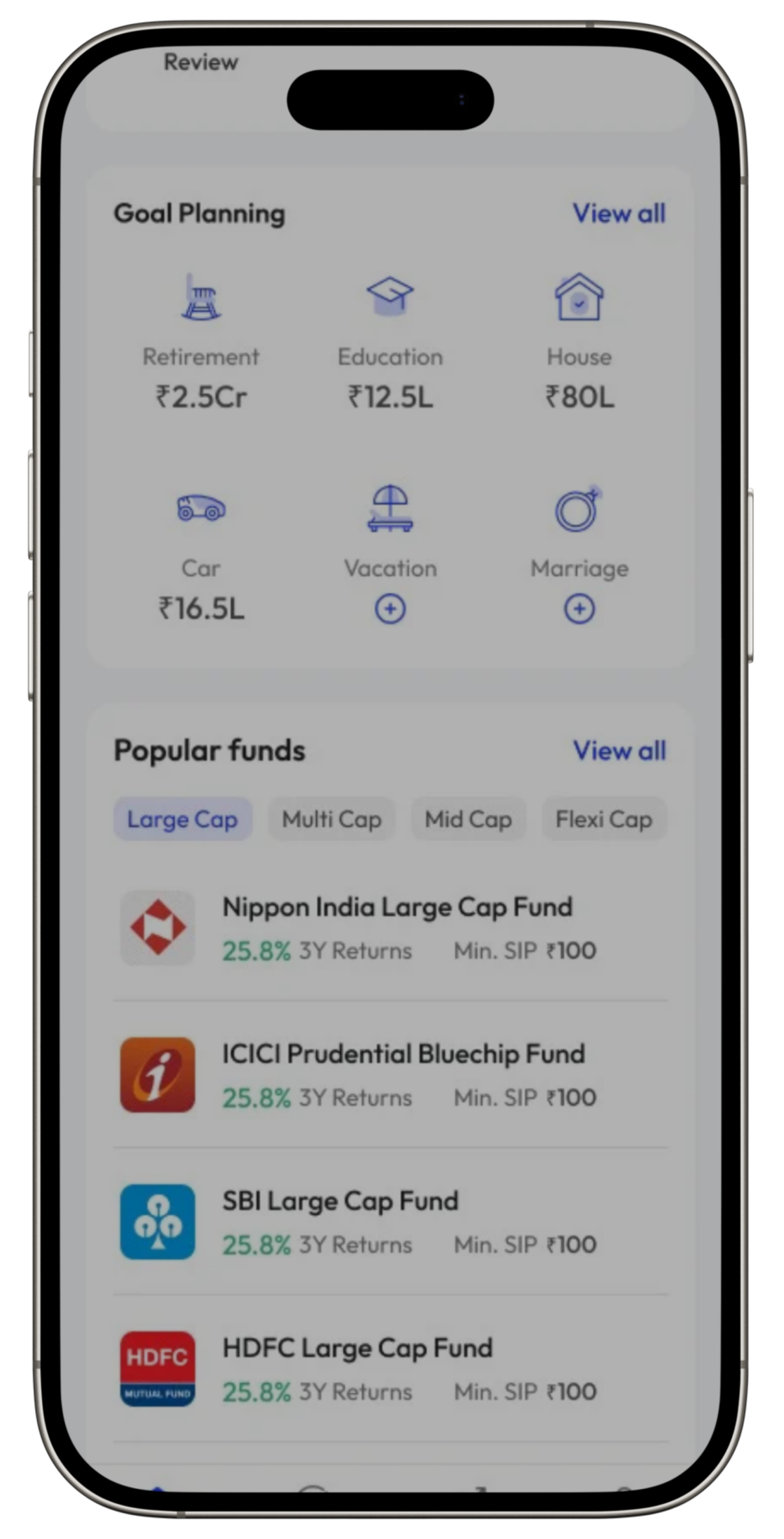

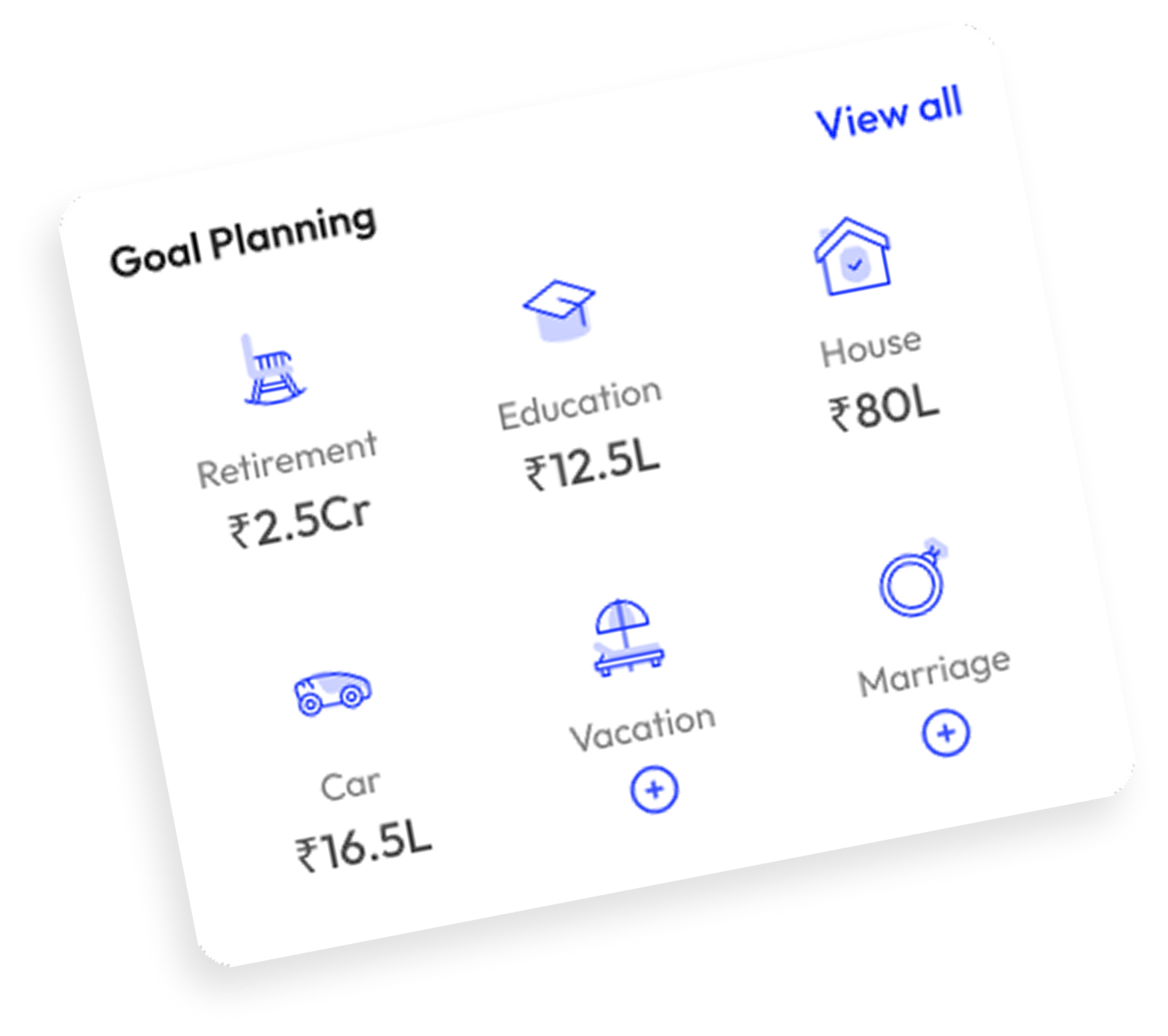

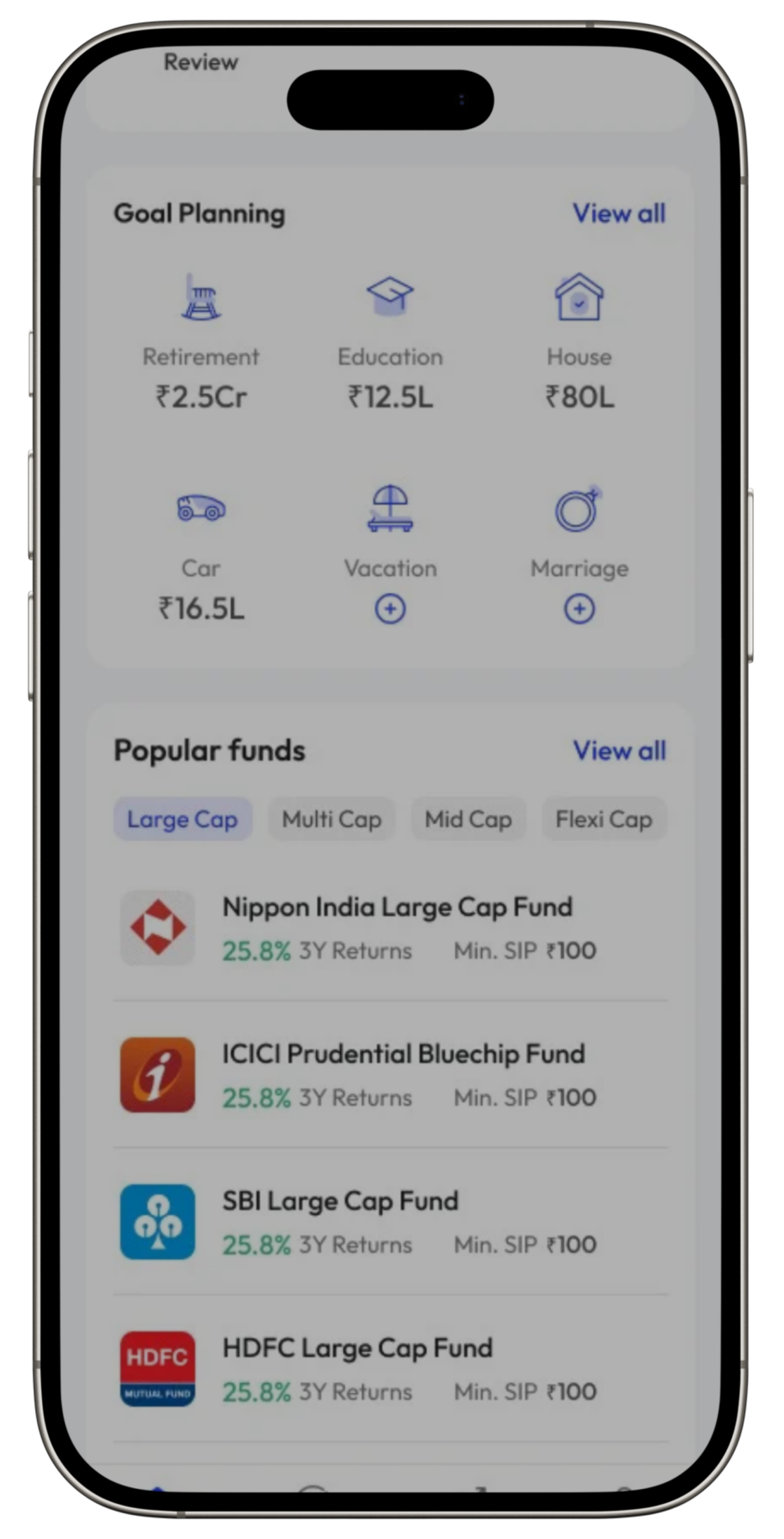

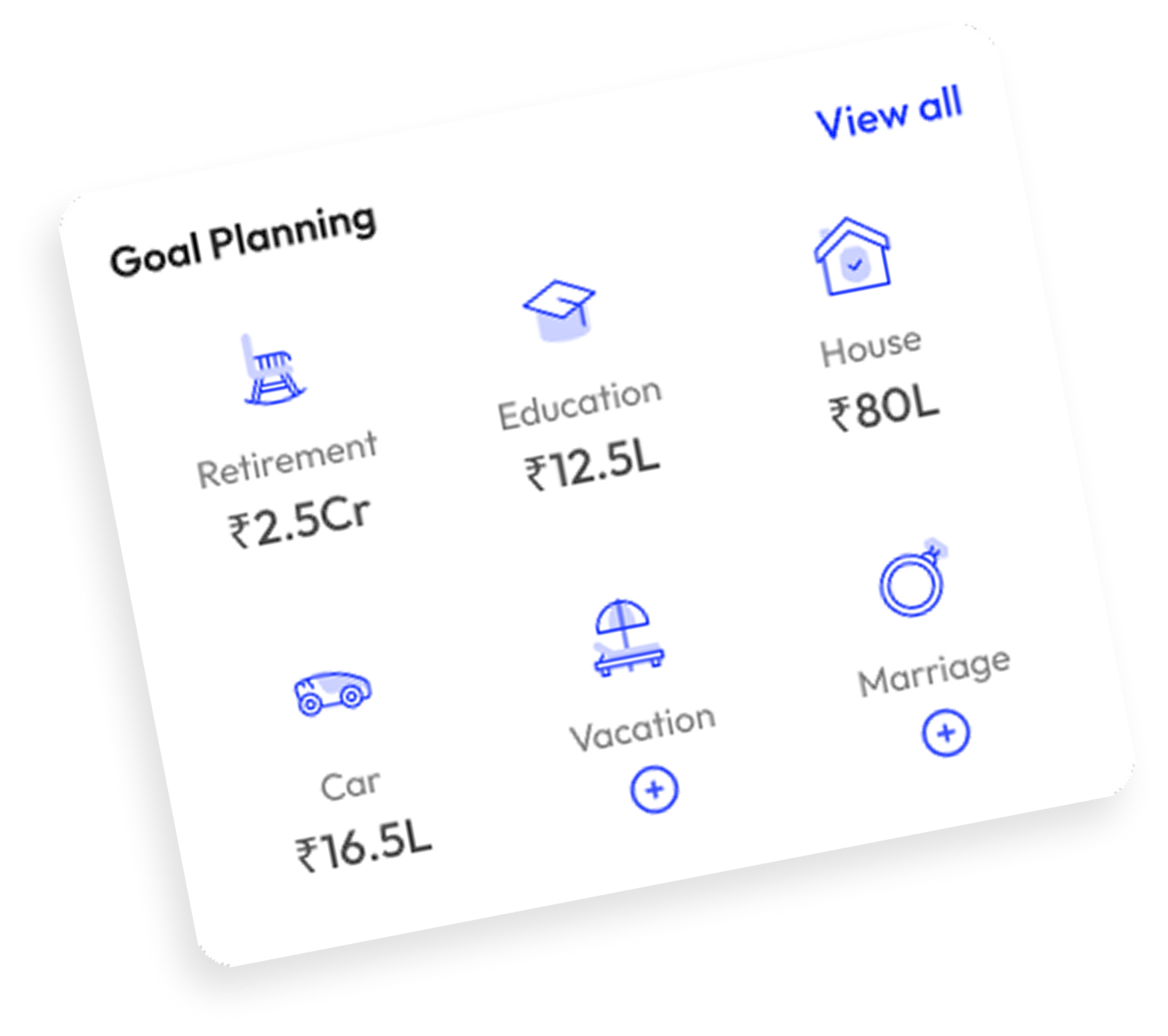

Plan big milestones like retirement, wedding, car, or home. Get future cost projections, exact investment amounts, and start achieving your goals today.

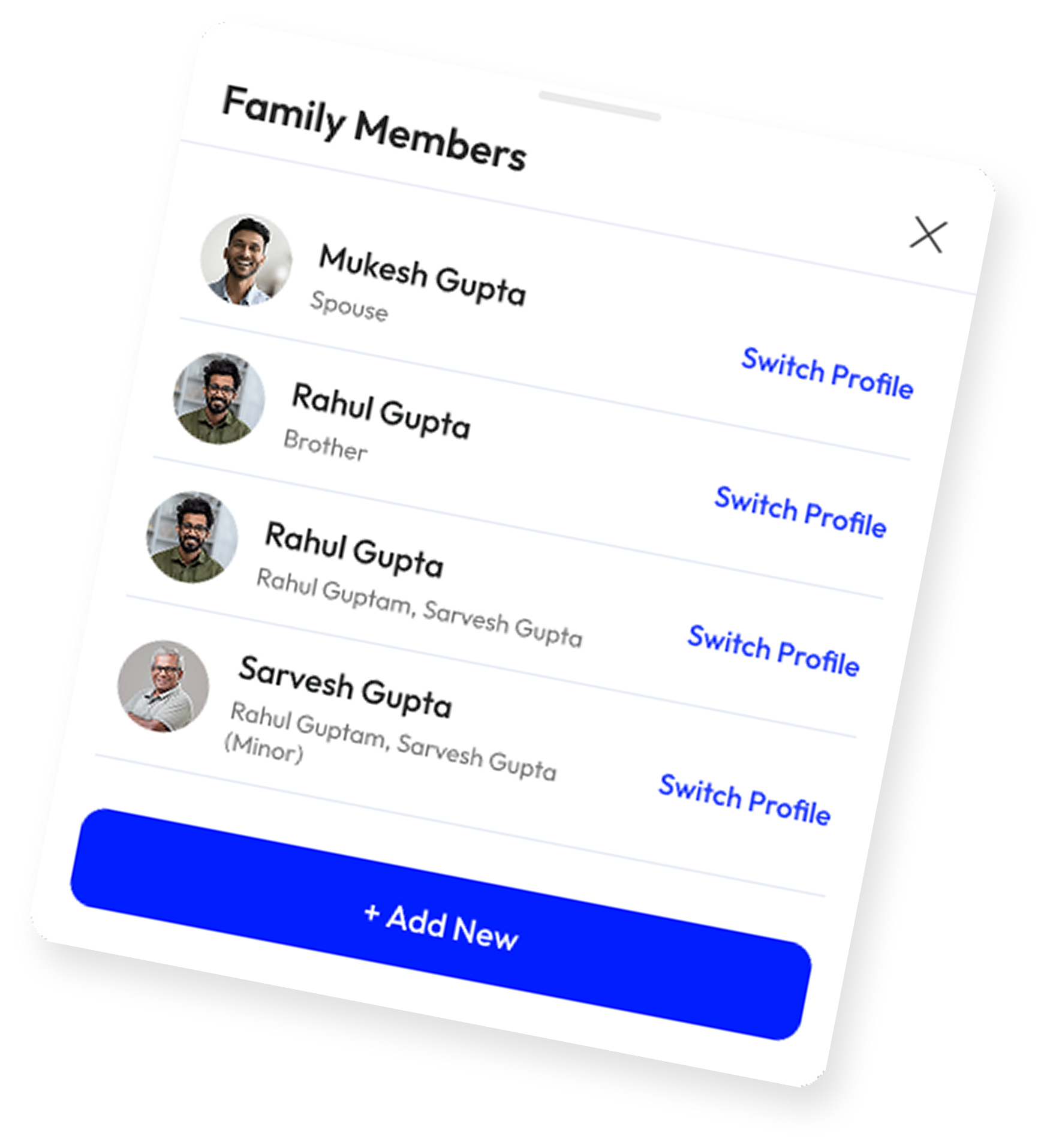

All family portfolios in one place. Add members, monitor investments, and manage seamlessly from a single, powerful app dashboard.

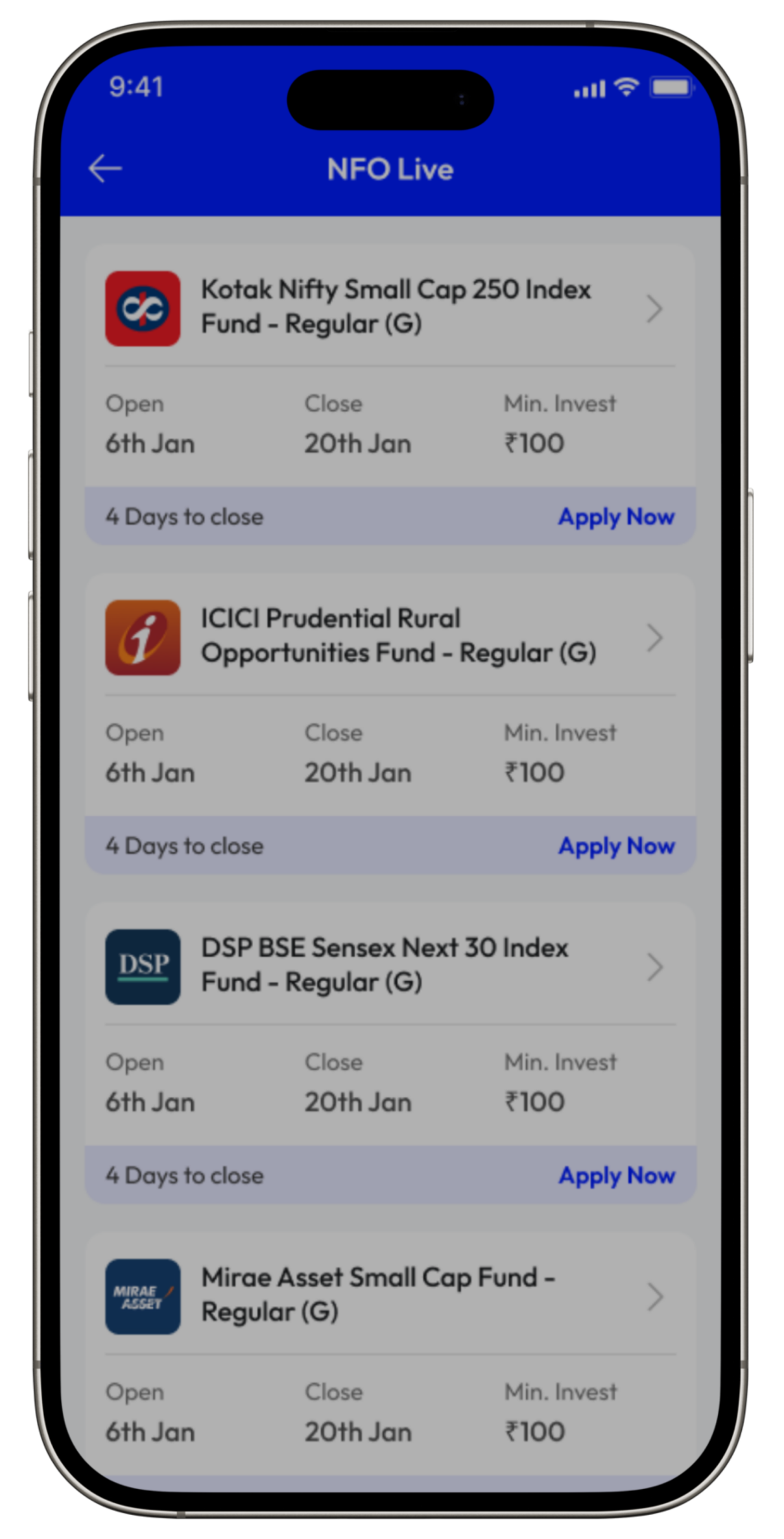

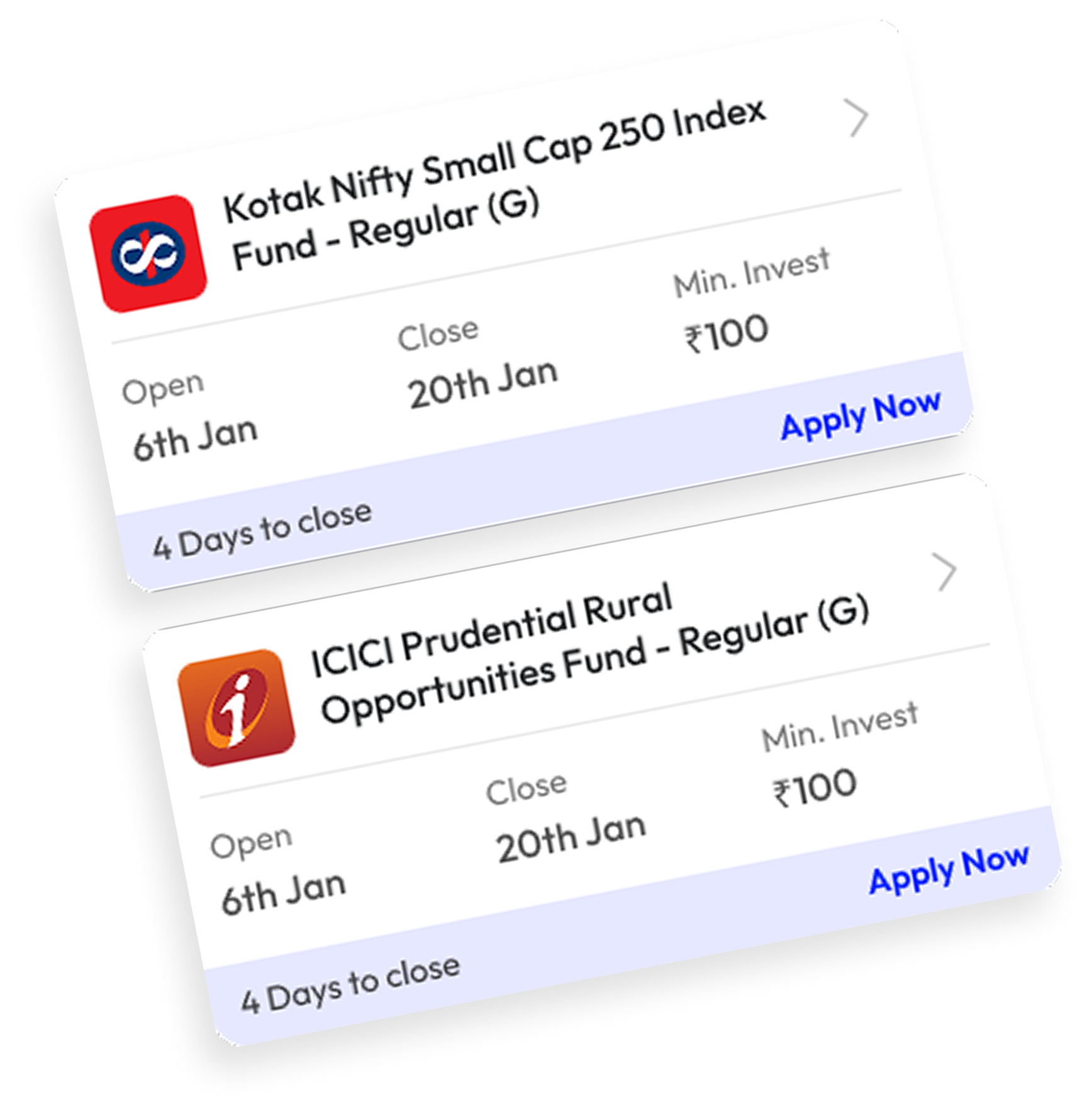

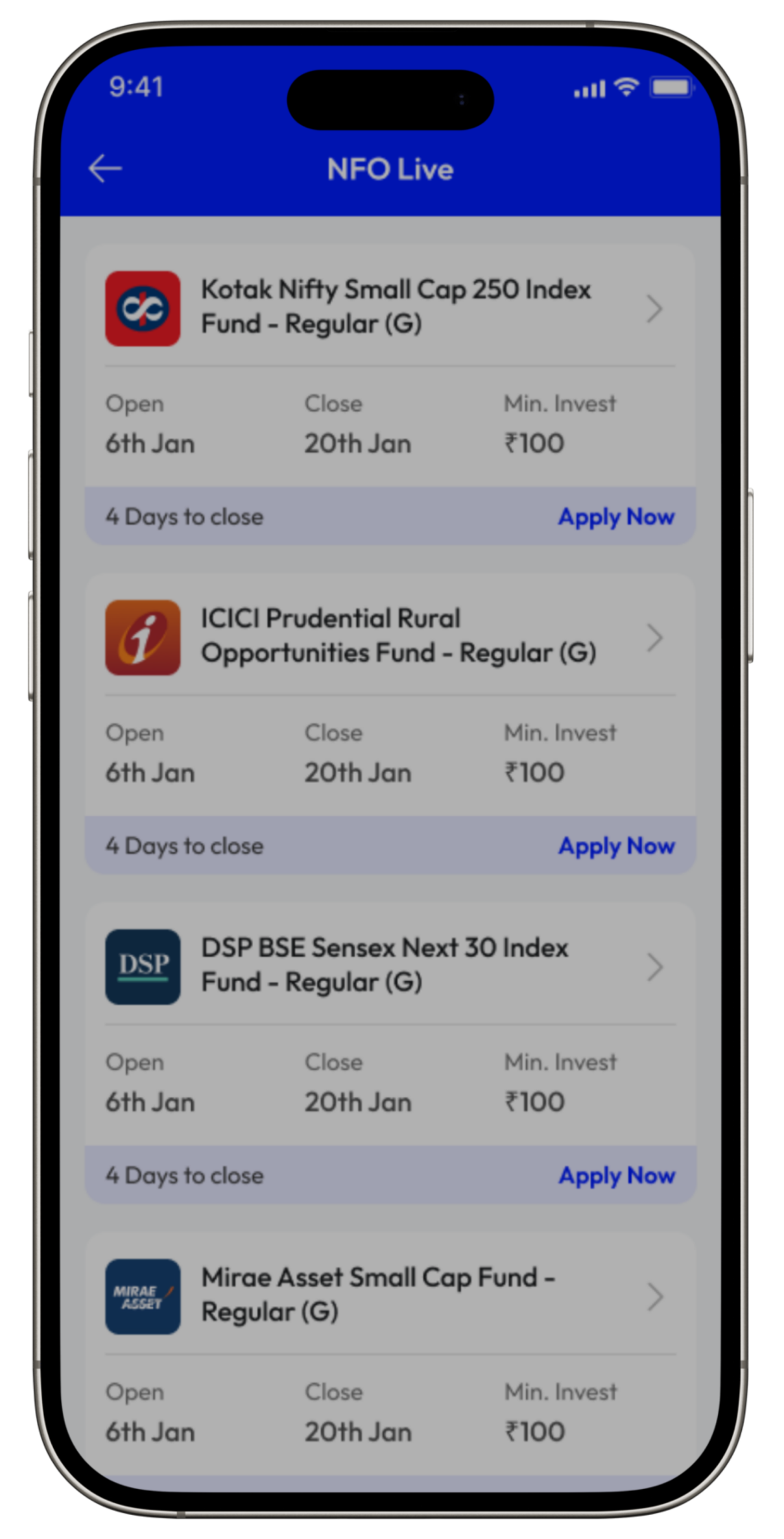

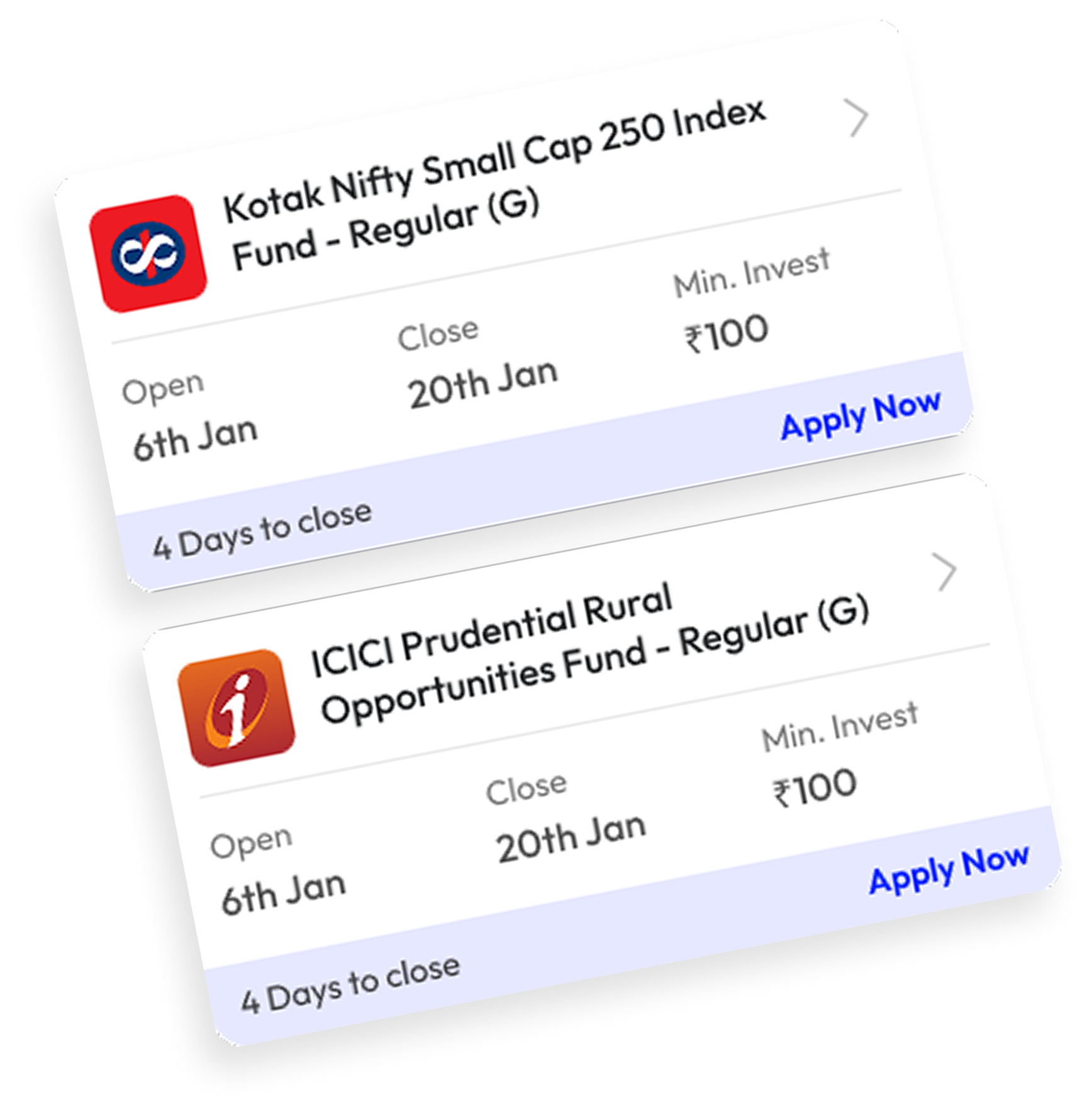

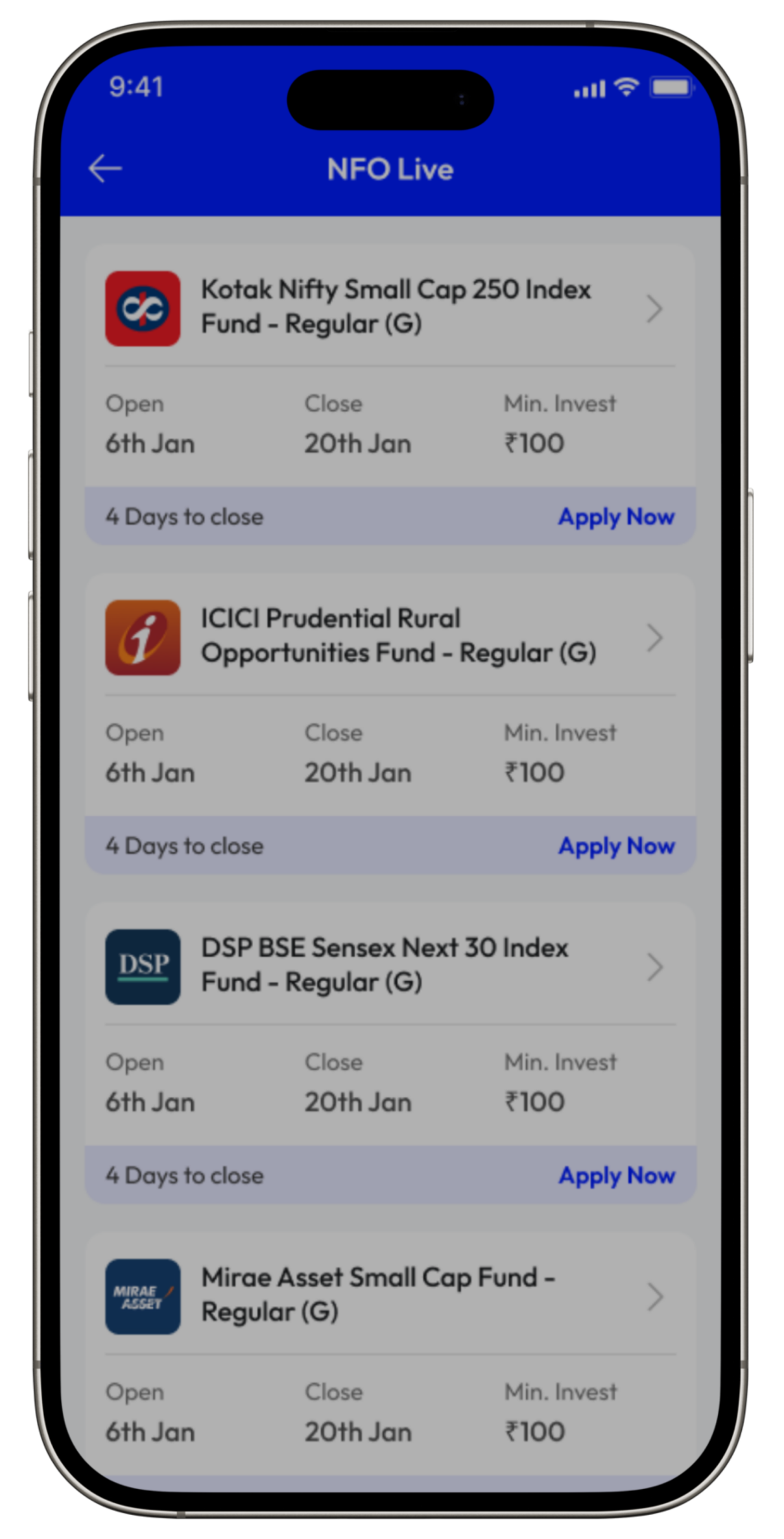

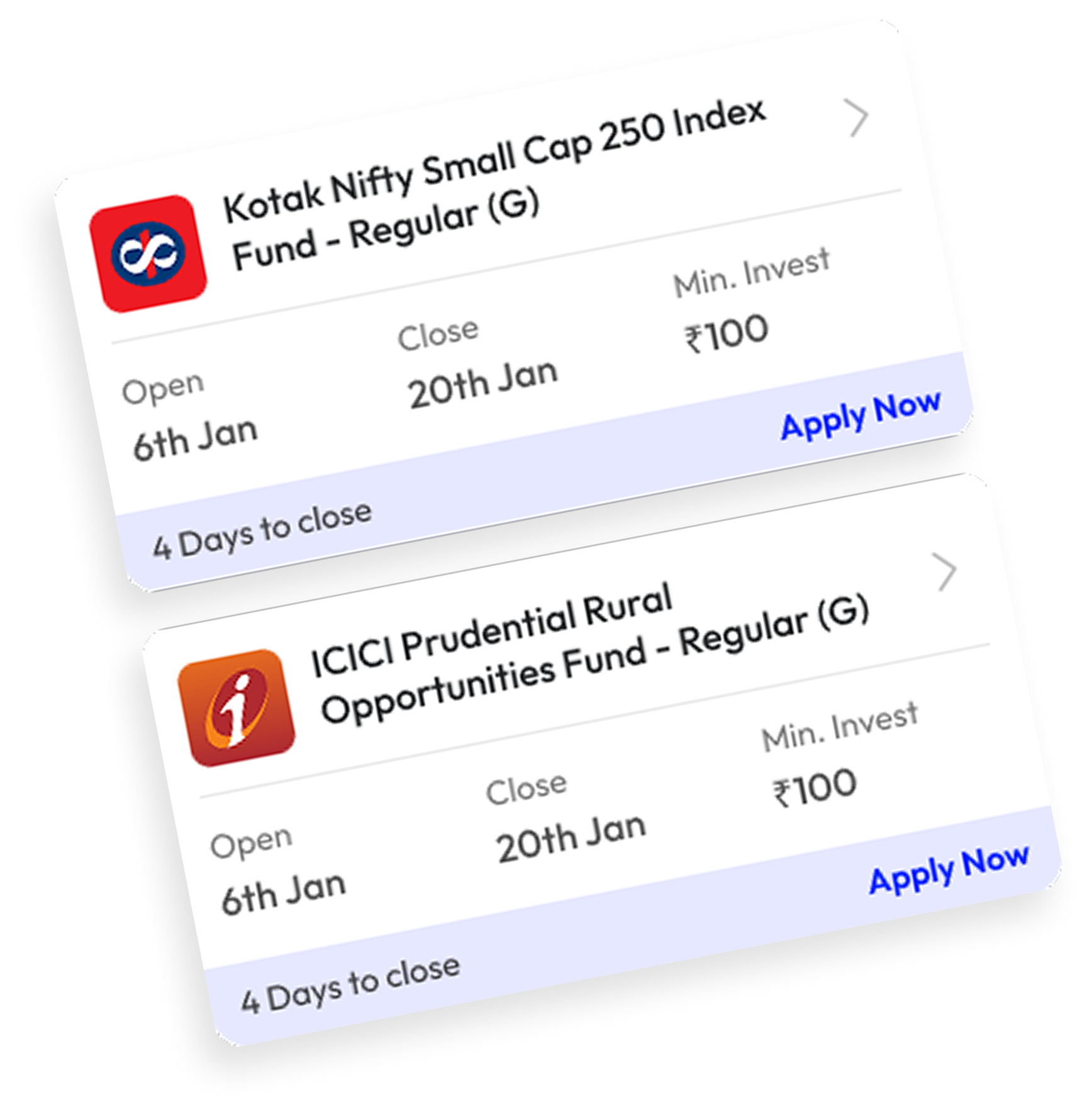

Stay ahead of your investment game with NFO Live! Discover, explore, and invest in the latest NFOs as soon as they launch. Get ready for early access, new opportunities, and never miss out on a new NFO! Also, let your dedicated RM guide you about the best NFO to invest in.

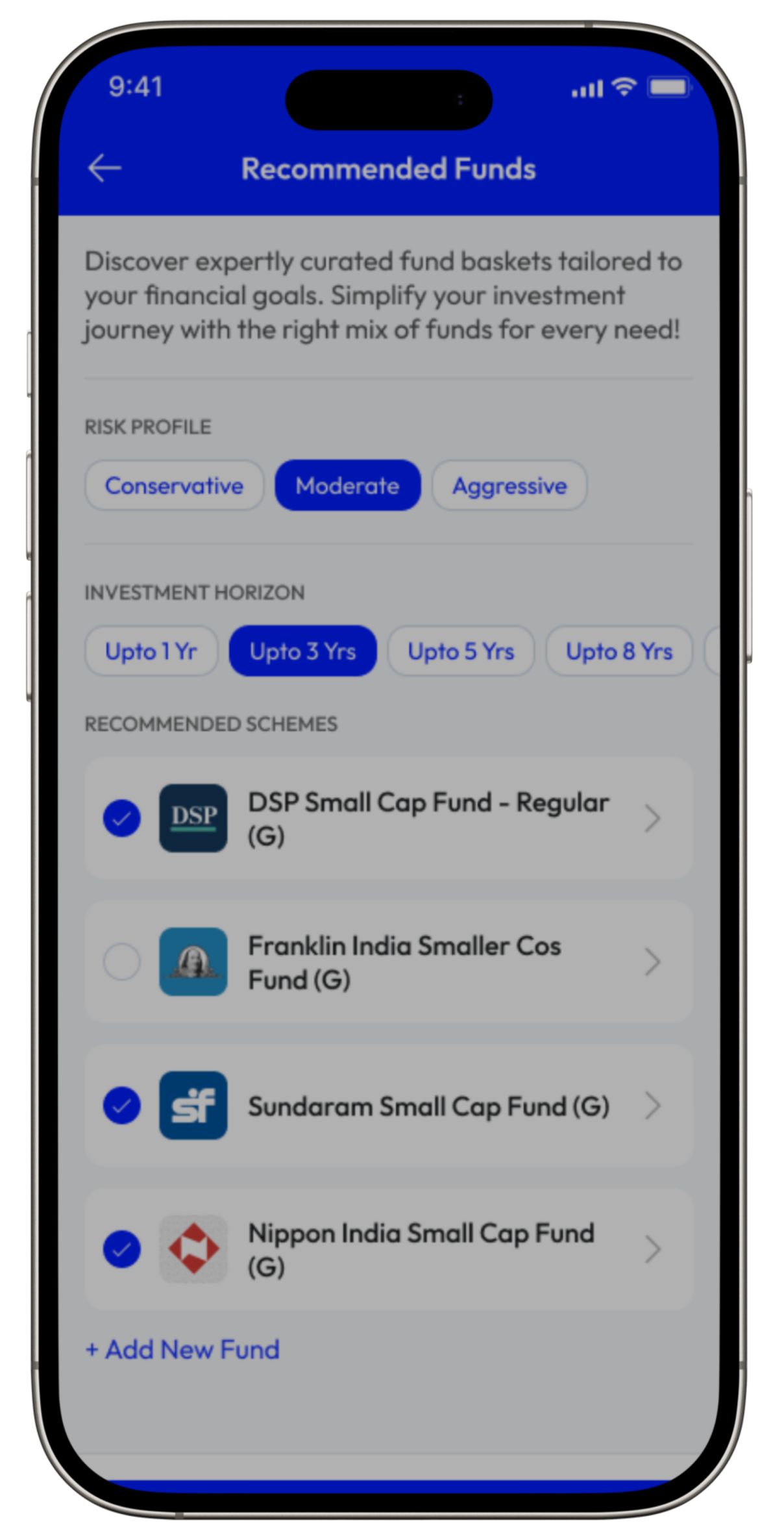

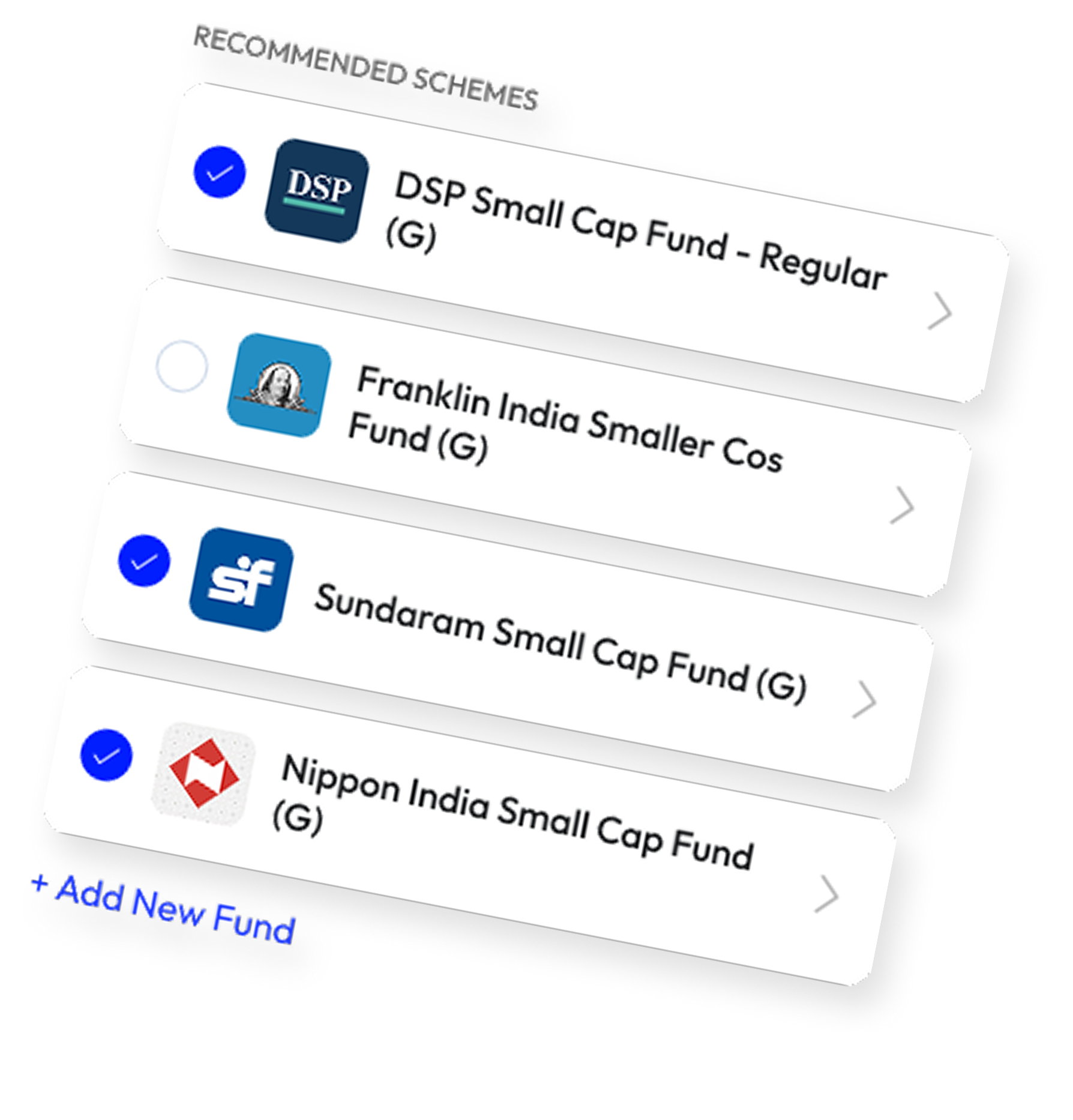

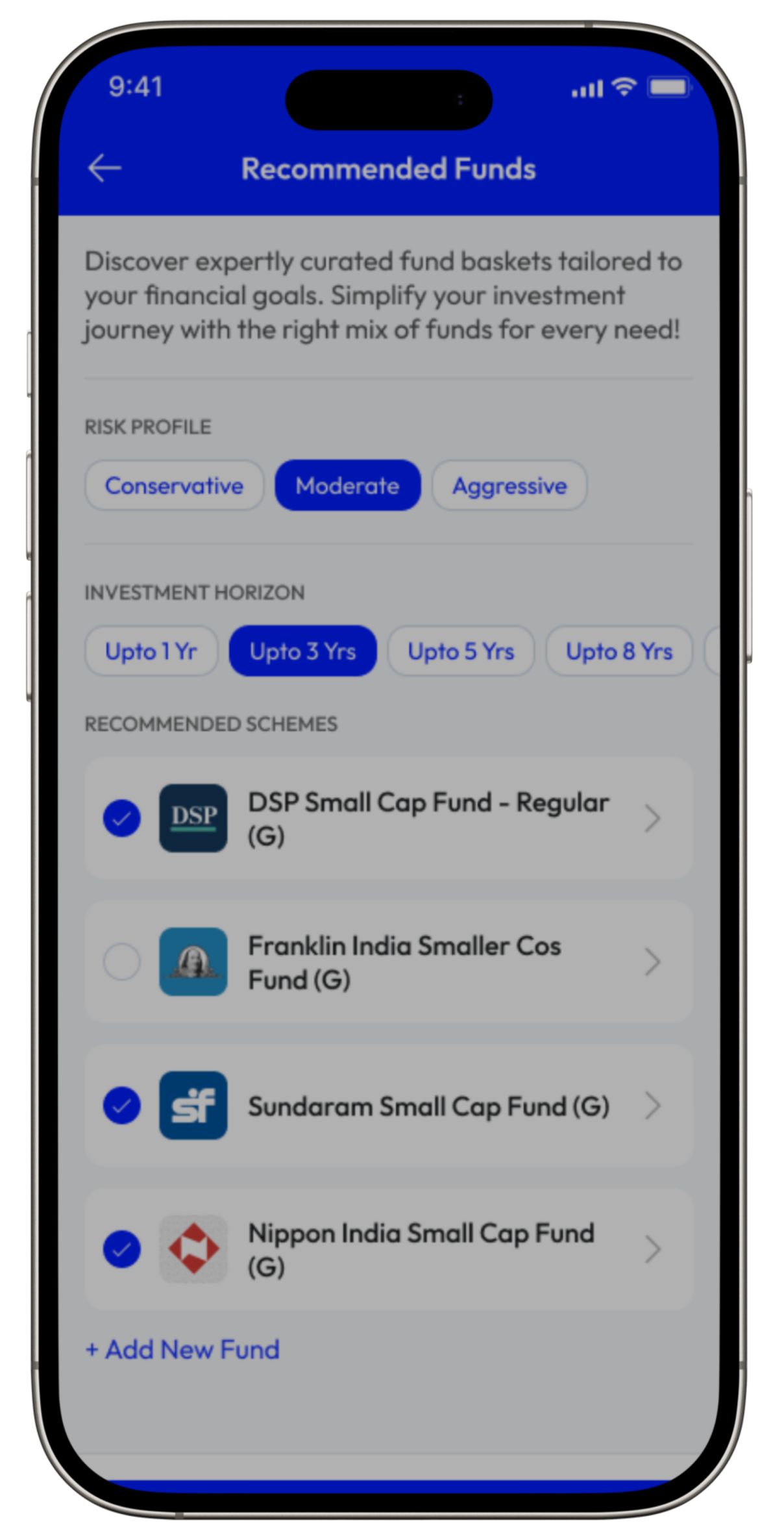

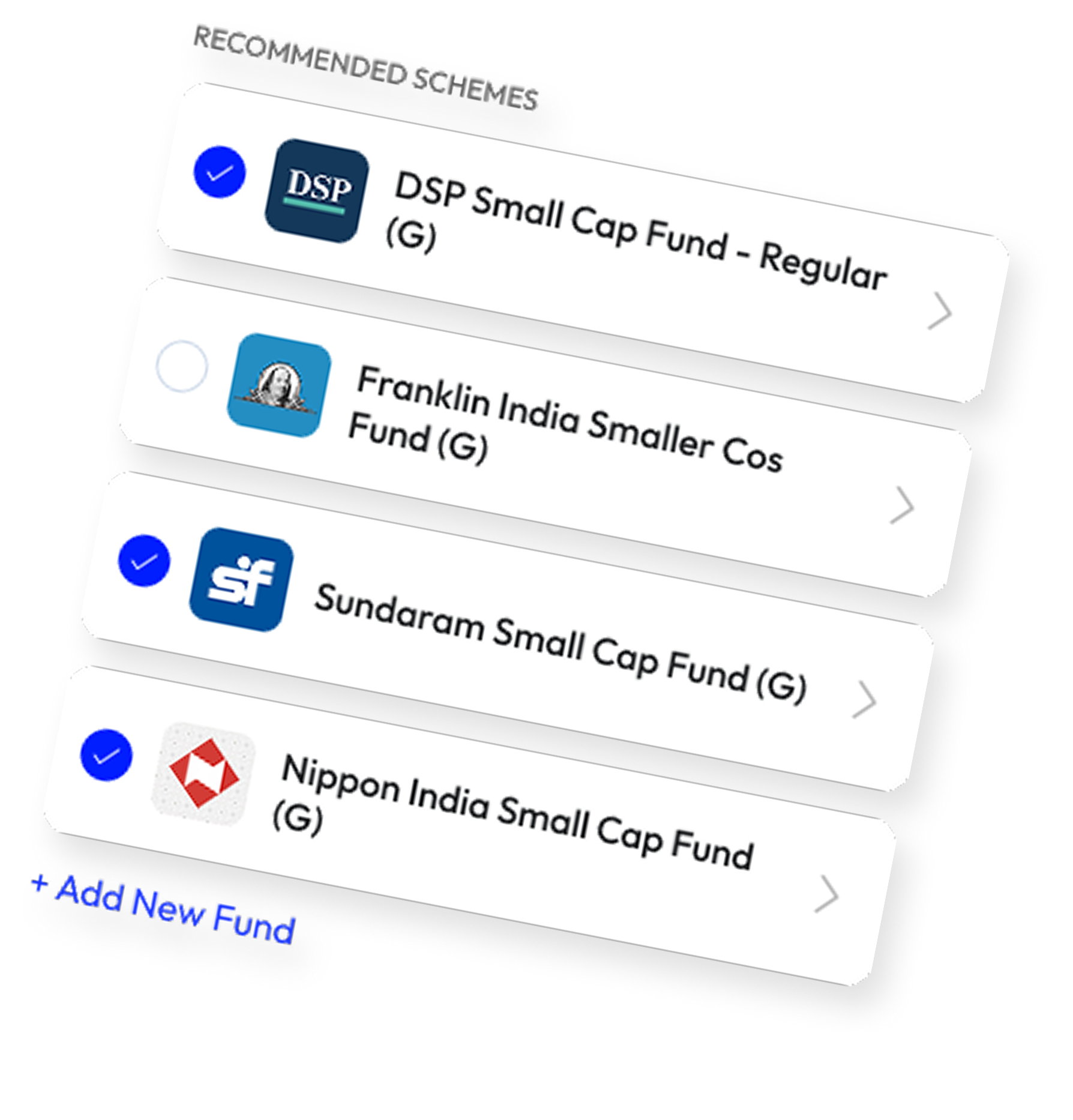

Enter your investment horizon and risk profile to get expert-picked, tailored schemes with complete details...then start investing in the perfect plan instantly.

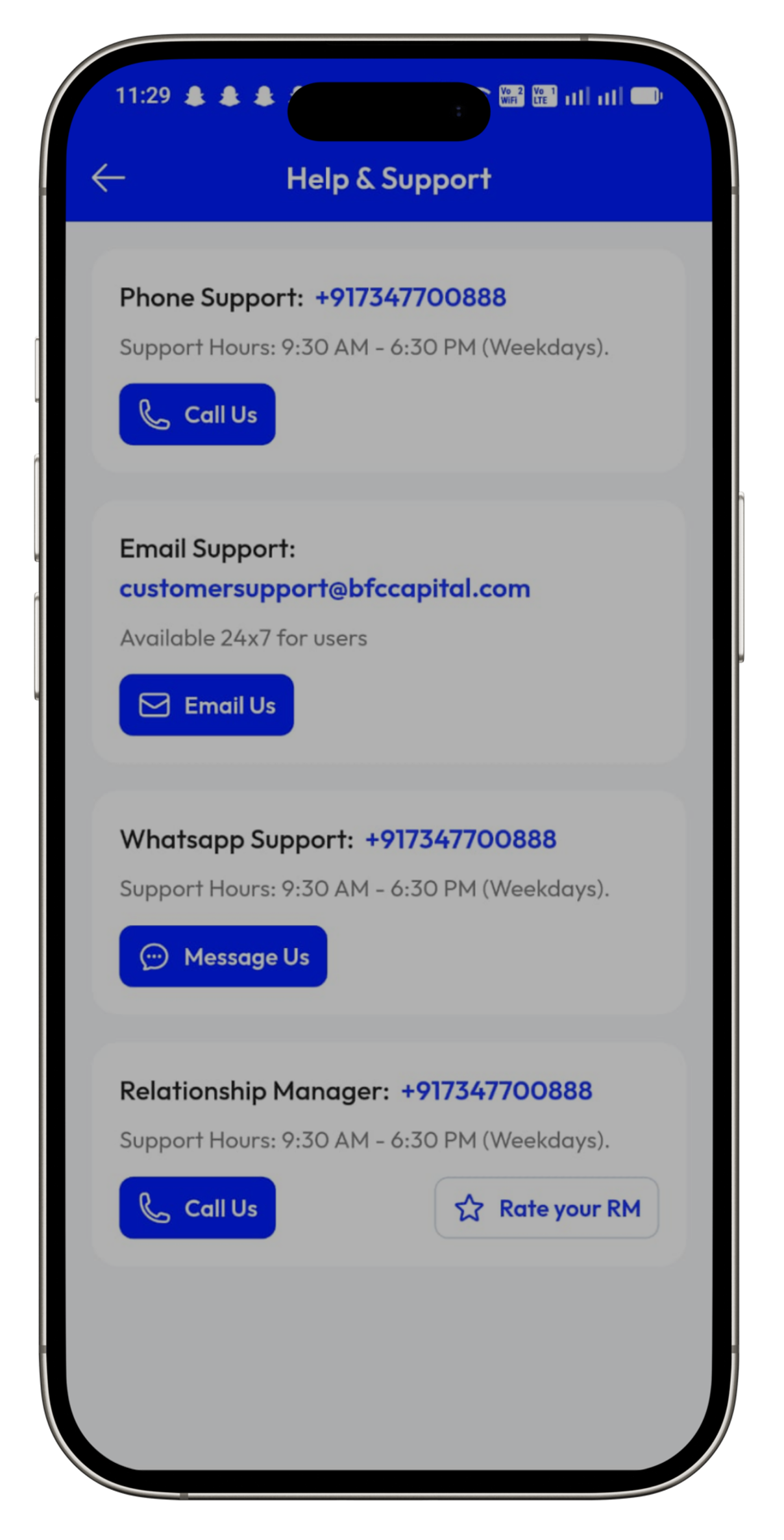

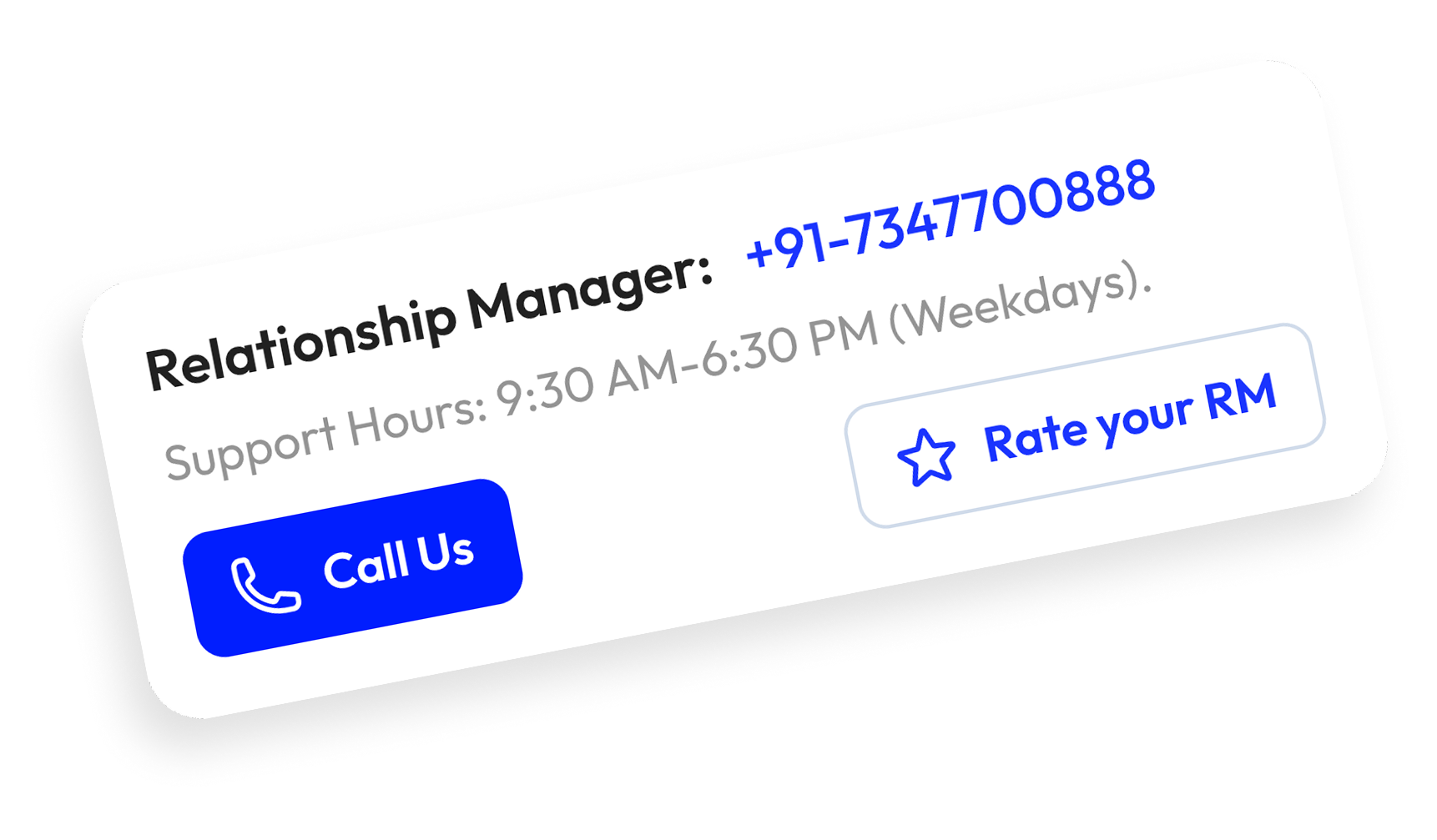

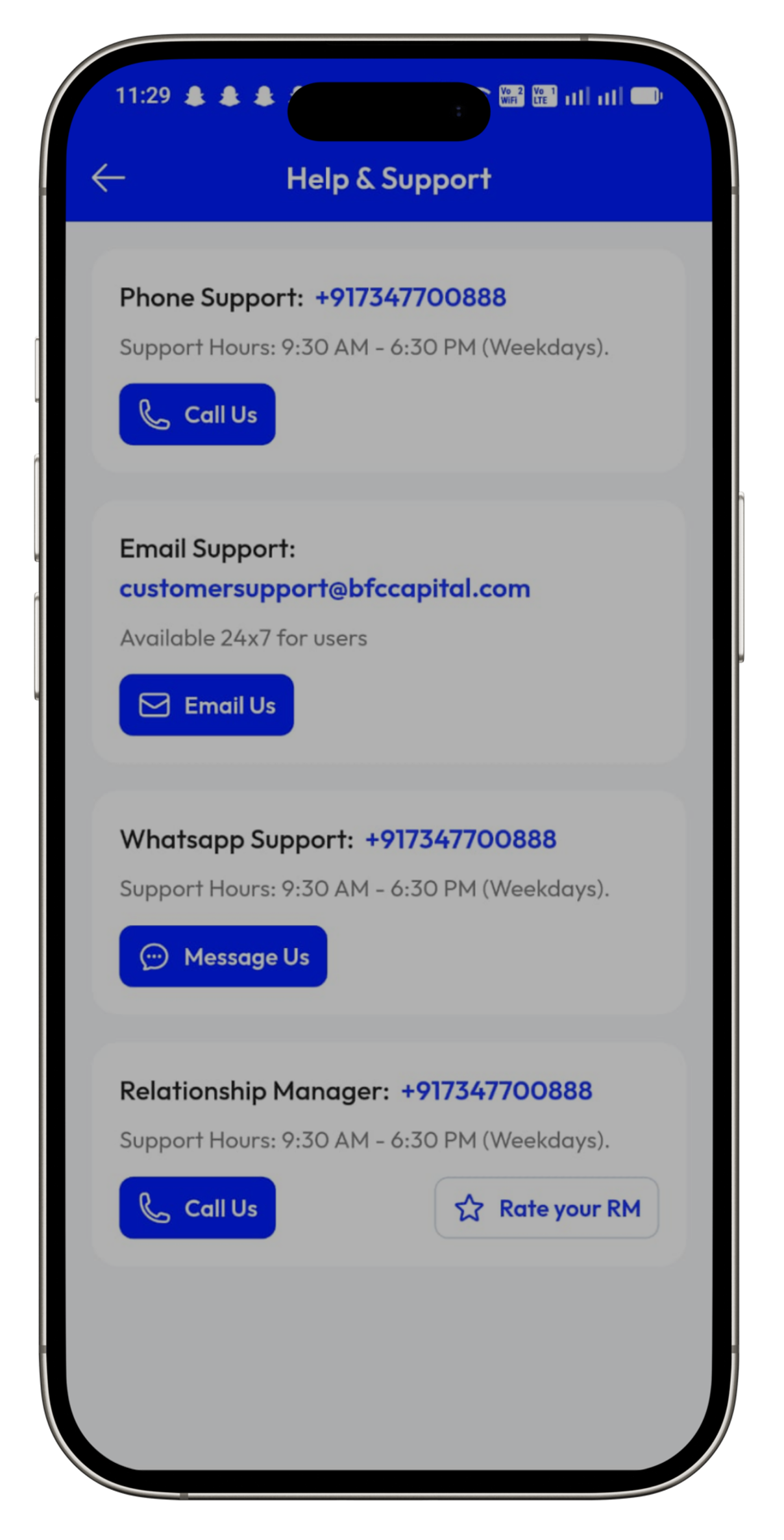

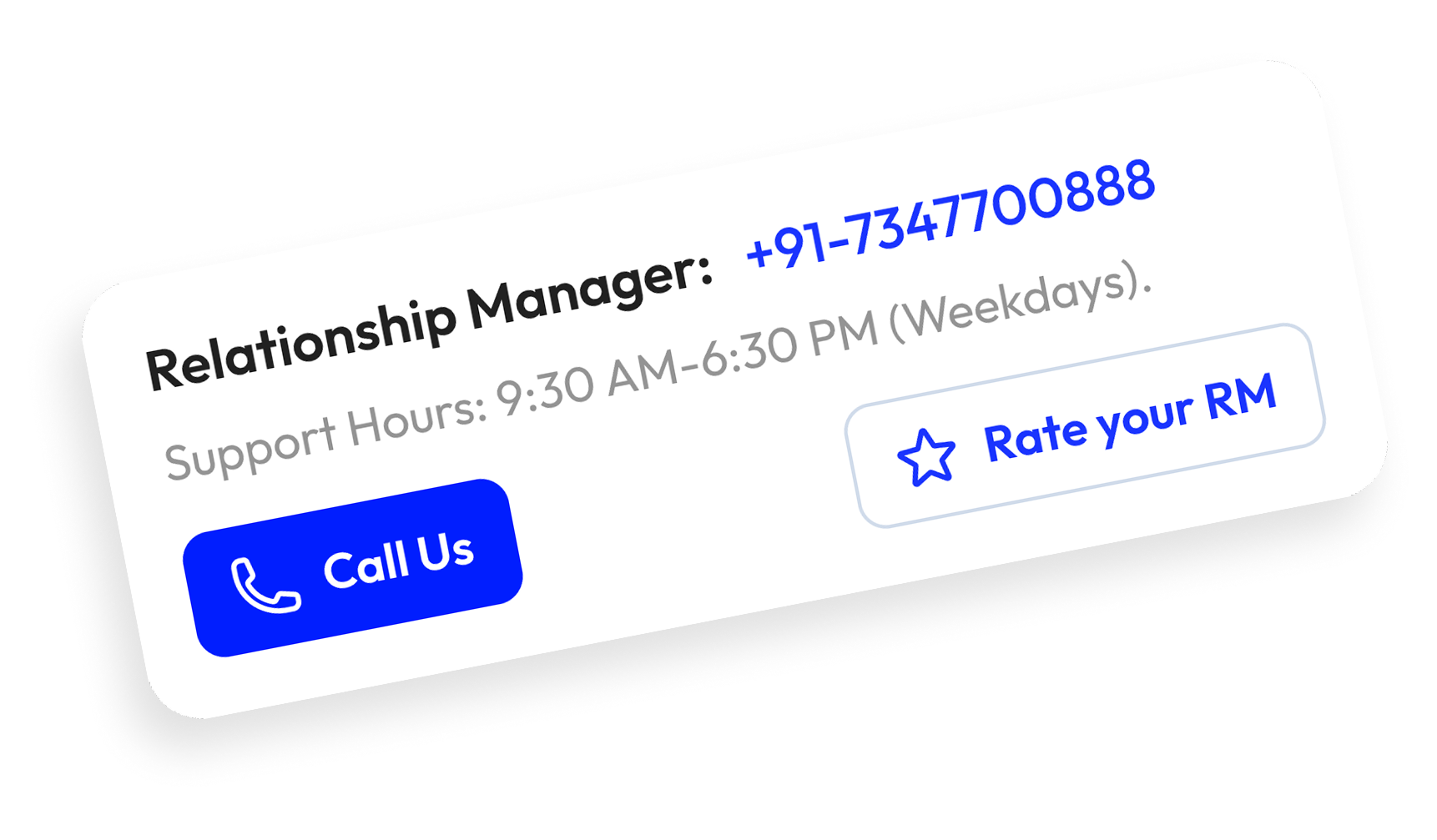

Enjoy personalised attention from your Relationship Manager...ready to assist, advise, handhold and resolve your investment queries anytime.

From breaking news to deep dives, we deliver content that keeps you informed, ready, and ahead in every market cycle.

Questions on your mind? Dont worry we have the answers!